My Stage 2 complaint re the unauthorised updating of my address by HM Revenue and Customs includes the issue of the unjustified closure of my Self Assessment record by the Customer Service Manager for PAYE and Self Assessment (WITH UPDATE 4/8/2017)

Re: Internet cuts since 26 May 2017

From my earlier blog post's Update 4 August (11.16am):

"And it's not just Facebook blocks, blocks on public access to our Church and State website and the daily targeting to fluctuating degrees of category pages throughout the site that Declan and I are dealing with these days. We have also been dealing with Internet cuts since 26 May. See my blog post of 21 June, Internet cuts: We pay £65 per month for BT Infinity but feel we are in a race against time to stay online (WITH UPDATE 4/8/2017 RE: 102nd Internet cut since 26 May 2017)."

We had to suspend work on our Church and State website on 15 June after 4 internet cuts in one night. With a then unprecedented 6 internet cuts on 6 July; 6 cuts on 22 July; 5 cuts on 1 August; 1 cut so far today (as of 4 August at 11.16am).

92nd 1 August 2017, 10.32am

93rd 1 August 2017, 3.47pm

94th 1 August 2017, 4.46pm

95th 1 August 2017, 8.19pm

96th 1 August 2017, 9.31pm

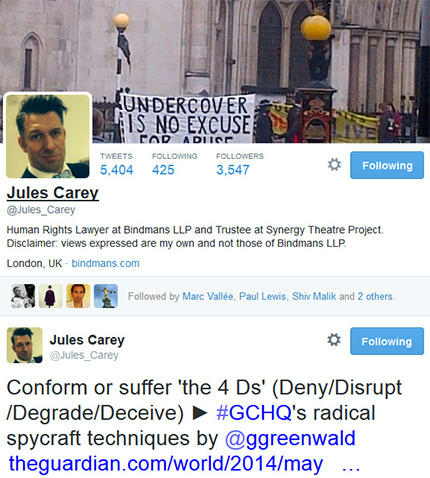

The War on Free Expression

From my earlier blog post's Update 4 August (11.16am):

"And it's not just Facebook blocks, blocks on public access to our Church and State website and the daily targeting to fluctuating degrees of category pages throughout the site that Declan and I are dealing with these days. We have also been dealing with Internet cuts since 26 May. See my blog post of 21 June, Internet cuts: We pay £65 per month for BT Infinity but feel we are in a race against time to stay online (WITH UPDATE 4/8/2017 RE: 102nd Internet cut since 26 May 2017)."

We had to suspend work on our Church and State website on 15 June after 4 internet cuts in one night. With a then unprecedented 6 internet cuts on 6 July; 6 cuts on 22 July; 5 cuts on 1 August; 1 cut so far today (as of 4 August at 11.16am).

92nd 1 August 2017, 10.32am

93rd 1 August 2017, 3.47pm

94th 1 August 2017, 4.46pm

95th 1 August 2017, 8.19pm

96th 1 August 2017, 9.31pm

The War on Free Expression

HMRC Customer Service Manager for PAYE and Self Assessment: "We previously asked you to complete Self Assessment tax returns because you told us that you would receive self-employed income. However, your 2015-16 return only included income of £2,967 from Network for Church Monitoring and as you had told us that this was PAYE income, we have closed your Self Assessment record" [emphasis added].

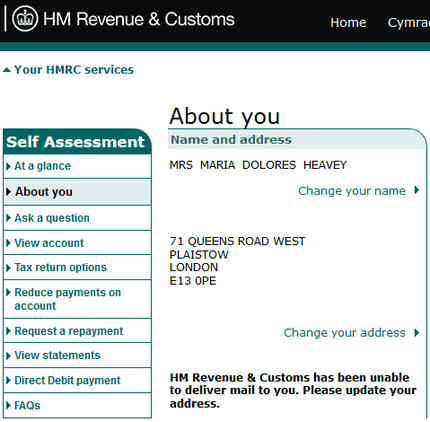

I read a letter from Her Majesty's Revenue and Customs Pay As You Earn (PAYE) and Self Assessment this morning in disbelief. For over three weeks, I have been complaining to HMRC about their unauthorised updating of my address on 11 July; see my blog post of 13 July, HM Revenue and Customs: My Self-Assessment address has been updated by HMRC without my authority and Declan has just been informed by Newham Council that our Housing Benefit may be suspended as a result (WITH DOUBLE UPDATE 14/7/2017). Now HMRC Customer Service Manager (PAYE and SA) John Fitzpatrick tells me that they have gone and closed my Self Assessment record. We have absolutely no idea how far HMRC are going to go with this; see my blog post 20 February, The Central London County Court: District Judge Avent dismisses Declan's claim against the Greater London Authority-commissioned St Mungo's that alleged the falsification and fabrication of data against us (WITH UPDATE 16/3/2017). As I did with my Stage 1 complaint, I have copied HMRC Chief Executive Jon Thompson into my Stage 2 complaint this afternoon:

For the attention of Jon Thompson, Chief Executive and Permanent Secretary of HM Revenue and Customs

Complaints Service (PAYE and SA) Tier 2

HM Revenue and Customs

Address removed for email

3 August 2017

Tax Reference [number removed]

Dear Operational Manager,

I believe that HMRC Customer Service Manager (PAYE and SA) John Fitzpatrick failed to deal properly with my complaint below. I attach his first tier response of 24 July 2017, which I received in this morning's post. Please treat this complaint as a Stage 2 complaint.

Newham Benefits Service (NBS) cannot provide my husband with assurance that his Housing Benefit will not be suspended as a result of the unauthorised updating of my address by HMRC on 11 July 2017. NBS's latest letter is also attached. They say the suspension will be automatic if NBS receives notification of a change in circumstance from either HMRC or the Department for Work and Pensions. As I have repeatedly stressed, my address has not changed since 17 May 2014. Please would you provide me with a letter stating that HMRC will not update my address again without my authorisation.

Further, I never told HMRC that I am self-employed or that I would receive self-employed income. I am not self-employed and I have never declared myself as such to HMRC or Newham Council. Mr Fitzpatrick writes: "We previously asked you to complete Self Assessment tax returns because you told us that you would receive self-employed income. However, your 2015-16 return only included income of £2,967 from Network for Church Monitoring and as you had told us that this was PAYE income, we have closed your Self Assessment record."

Please would you also provide me with immediate assurance that my Self Assessment record has not, and will not, be closed. To clarify, I am employed as the Webmaster for Network for Church Monitoring (N4CM). My 2015-16 Self Assessment tax return only included income from N4CM of £2,967 (untaxed income). Contrary to what Mr Fitzpatrick says, I never told HMRC this was PAYE income. My 2015-16 return included a declaration that I do not have the PAYE tax reference from my employer because my annual earnings fell below the PAYE tax threshold (then £10,600 per year). There is absolutely no justification for the closure of my Self-Assessment record.

This morning I tried speaking with Hazel McMaster at PAYE and Self Assessment Complaints. I was told that she would phone me back, but she never did. I was assured that my Self Assessment record is currently open. I was not, however, provided with any assurance that the issue of the unjustified closure of my Self Assessment record by Mr Fitzpatrick will be handled by HMRC in accordance with the appropriate laws.

Yours faithfully,

Maria Dolores Heavey

NINO: [number removed]

7 July: Complaint to the CEO of Royal Mail: Has Royal Mail declared open warfare on our incoming mail? And this question is raised on top of Internet cuts that are going out of control (WITH DOUBLE UPDATE 10/7/2017)

UPDATE 4 August (12.14pm): I am still waiting for written assurance from HMRC that my address will not be updated by them again without my authority, and that the issue of the unjustified closure of my Self Assessment record by the Customer Service Manager for PAYE and Self Assessment will be handled by HMRC in accordance with the appropriate laws. You couldn't make it up: it has taken us over three years to try and secure our address with HMRC; and now, based on fabricated hearsay evidence which no independent judiciary would accept, the Customer Service Manager for PAYE and Self Assessment writes to me: "...we have closed your Self Assessment record". It is our single indisputable narrative going forward that we are being harassed even by HMRC; see my blog post of 29 November 2016, Will it take the Independent Police Complaints Commission to protect our address with HM Revenue and Customs? (WITH UPDATE 22/12/2016).

From My Picks:

9 June: Ministry of Justice: Complaint to the Lord Chancellor and Secretary of State for Justice against the County Court at Central London, Royal Courts of Justice (WITH UPDATE - Day 13 21/6/2017)

'Let me recommend an important web site churchandstate.org.uk. Operating out of London this well-designed and exciting web site covers church-state, population, climate change and other issues. Check it out.' Edd Doerr, President, Americans for Religious Liberty